Canberra is still one of the country's best performing economies on the back of strong population growth, but any tightening of the federal budget could take some wind out of its sails, a new Deloitte report says.

Subscribe now for unlimited access.

$0/

(min cost $0)

or signup to continue reading

It comes a separate report from BIS Oxford Economics, also published on Monday, said the introduction of first home buyer stamp duty exemptions in the ACT from July 1 was expected to help housing price growth.

It said the median house and unit prices were forecast to rise by 10 per cent in the three years to June 2022.

"Although unit price rises will be weighted toward the end of the forecast period as the current supply pipeline is worked through," it said.

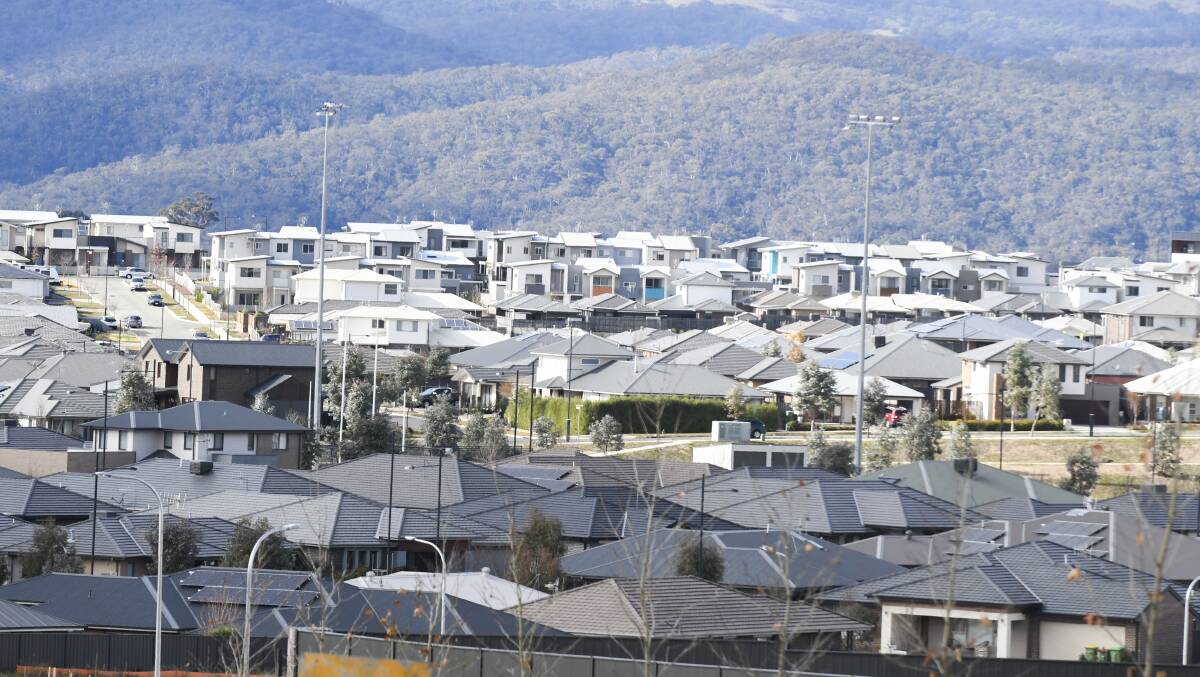

A 10 per cent increase would take the median house price in Canberra from $680,000 to $750,000 in June 2022, the BIS Oxford report said. This would be the third highest median in the nation, behind Sydney ($1.04 million) and Melbourne ($810,000).

The 10 per cent growth would also be the third highest over the three-year period, behind Brisbane (20 per cent) and Adelaide (11 per cent).

The report said the minimal house price growth in Canberra from 2017-18 to 2018-19 had been impacted by record unit supply, an impending federal election and first home buyer incentives in New South Wales.

RELATED NEWS:

The June Deloitte Access Economics Business Outlook, released on Monday, said the ACT should continue to benefit from strong growth in public spending with the federal budget in its best shape since 2009.

But it noted the return of the Coalition government meant cuts to the public service, with the 2 per cent efficiency dividend maintained for another two years.

But luckily for the ACT, the public sector is not the only game in town, with substantial job creation in construction, tertiary education and research sectors, the report said.

Strong growth in the number of international students - supported by the low Australian dollar and rising incomes in east Asia - has contributed the territory's strong population growth, behind only that of Victoria. These strong rates of population growth have propped up spending in the territory's shops despite Canberra sharing the same weak wage growth found across the country, the report said.

Canberra's healthier housing market, which has not seen falls as large as most major Australian markets, has increased incentives for housing investment and explains why residents' rents continue to grow, the report said.

The report said much of the improvement in the federal budget position was probably due to temporary strength in commodity prices and spending restraint.

This has reduced the need for any further public sector staff cuts - for now.

"Any resulting deterioration in the budget position could lead to further cuts in public sector spending, reducing employment opportunities in the ACT," the report said.

"This would result in a broader deterioration in the territory's economy, as we have seen during previous periods of public sector austerity."

The report noted that engineering construction work had fallen significantly since the end of major construction on the light rail.

There have also been falls in the telecommunications sector as work wraps up on the NBN.

"But there is some good news. The latest ACT budget has set aside more than half a billion dollars for new capital works over the next four years, up from a quarter of a billion last year," the report said.

It said commercial construction work had pulled back, particularly in the retail, education and entertainment and recreation sectors.

"But there are some bright spots. In particular, there's still a lot of construction work under way and planned in the offices, accommodation and health sectors.

"Plans for the redevelopment of Canberra Hospital have been expanded to include additional beds and operating theatres. The cost of the development may exceed the original $500 million commitment, while the end date is likely to be pushed back by at least a year."